In the foreseeable future, the bitcoin market may collapse, and the price of the flagship asset may fall back to the values of the first half of 2024 or lower, suggested an analyst at TradingView under the pseudonym Dick Dandy.

Dick Dandy’s theory describes the Bitcoin market as a «dollar balloon» filled with liquidity from market makers, firms that provide a flow of buy and sell orders for seamless trading.

The analyst believes that market makers and whales compete with crypto traders, encouraging them to borrow liquidity and open positions with high leverage. However, they ultimately want to recover their money, ensuring that retail players do not profit from their trades.

«Traders often use leverage, which can be up to 100 times the size of their positions, to speculate on the growth or decline of crypto assets, while market makers and whales use their resources to manipulate prices and move them towards areas with the highest concentration of stop-loss orders,» says Dick Dandy.

Such actions trigger a cascade of liquidations, when the triggering of automatic orders causes a wave of sell-offs, intensifying the price drop. This allows manipulators to buy back assets at a discounted price and profit from the market recovery, the analyst noted.

Dandy explains the possible collapse of the Bitcoin market by the current structure of the cryptocurrency market. According to the expert, the capitalization of Bitcoin mainly depends on derivatives, such as term and perpetual futures, rather than on long-term holders. According to Dandy’s calculations, accumulated sell orders in consolidation zones create «fuel for a future crash,» and the longer the delay, the more it will affect the cryptocurrency market and the value of Bitcoin.

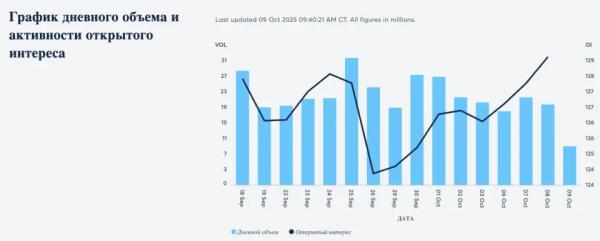

The crypto analyst’s concerns are indirectly confirmed by data from the CME Group platform, which shows a steady interest from traders, an active influx of capital into Bitcoin futures, and a possible overheating of the first cryptocurrency market.